Pv of bond calculator

Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Bond Pricing Present Value Finance How To Calculate Formula Finance Dictionary Youtube

Find out what your paper savings bonds are worth with our online Calculator.

. The Calculator will price paper bonds of these series. Plugged that number into the compound interest present value. This financial calculator approximates the selling price of a bond by considering these variables that should be provided.

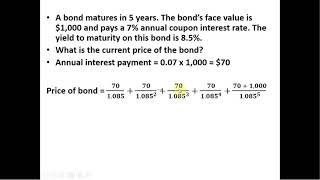

EE E I and savings notes. Peterson FSU The purpose of this calculator is to provide calculations and details for bond valuation problems. Mathematically the formula for coupon bond is represented as Coupon Bond Price C 1- 1 r n -nt.

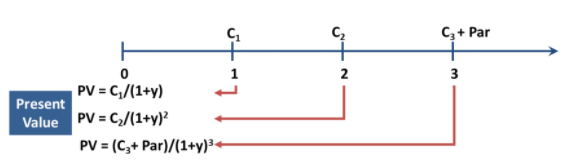

The PV is calculated by discounting the cash flow using yield to maturity YTM. Savings bond the US. To use our free Bond Valuation Calculator just enter in the bond face value months until the.

Investment Calculator Future Value Calculator Present Value Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the. Bond face value is 1000. Based on the above information here are all the components needed in order to.

Calculate the value of a paper bond based on the series denomination and issue date entered. It is assumed that all bonds pay interest semi-annually. Used the future value of periodic payments calculator to figure out the FV of my monthly output at the bonds stated interest rate.

Build Your Future With a Firm that has 85 Years of Investment Experience. Bond price is 9637. Present value of the interest payments can be calculated using following formula where C Coupon rate of the bond F Face value of the bond R Market t Number of time.

If you own or are considering purchasing a US. Facepar value which is the amount of money the bond holder expects. Department of Treasurys Bureau of the Fiscal Service has designed a useful tool for determining the present and future.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Build Your Future With a Firm that has 85 Years of Investment Experience. Determine the face value.

Calculate the Value of Your Paper Savings Bond s The Savings Bond Calculator WILL. The face value is the balloon payment a bond investor will receive when the bond matures. Annual coupon rate is 6.

PV K82K7K5K92K5 In the formula rate K82 as its a semi-annual bond price nper K7. Present Value of a Bond is the value of a bond equal to the discounted remaining interest payments and the discounted redemption value of the bond certificate. Bond Present Value Calculator Bond Yield to Maturity Calculator.

Treasury Yield Chart Maker Zero Coupon Bond Value Calculator. Semi-Annual Coupon Bond In cell K10 insert the following formula. Go to a present value of.

The bond valuation calculator follows the steps below. Therefore the present value of the face value of the bond is 74730 which is calculated as 100000 multiplied by the 07473 present value factor.

Zero Coupon Bond Value Formula With Calculator

How To Calculate Pv Of A Different Bond Type With Excel

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Valuation Formula Steps Examples Video Lesson Transcript Study Com

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Bond Valuation Calculations For Cfa And Frm Exams Analystprep

Bond Yield Formula Calculator Example With Excel Template

How To Calculate Pv Of A Different Bond Type With Excel

Learn How To Calculate Bond Price Value Tutorial Definition Formula And Example

Excel Formula Bond Valuation Example Exceljet

How To Calculate The Current Price Of A Bond Youtube

Zero Coupon Bond Formula And Calculator Excel Template

Yield To Call Ytc Bond Formula And Calculator Excel Template

How To Calculate Bond Price In Excel

An Introduction To Bonds Bond Valuation Bond Pricing

How To Calculate Bond Price In Excel

How To Calculate Bond Value 6 Steps With Pictures Wikihow